In the next couple of months, millions of students will be graduating and moving out of their parents home. If you’re a soon-to-be empty nester considering downsizing or making a move, let’s get together to discuss your options! Contact Roby Robertson for all the info you will need.

The Benefits of a 20% Down Payment

If you are in the market to buy a home this year, you may be confused about how much money you need to come up with for your down payment. Many people you talk to will tell you that you need to save 20% or you won’t be able to secure a mortgage.

The truth is that there are many programs available that let you put down as little as 3%. Those who have served our country could qualify for a Veterans Affairs Home Loan (VA) without needing a down payment.

These programs have cut the savings time that many families would need to compile a large down payment from five or more years down to a year or two. This allows them to start building family wealth sooner.

So then, why do so many people believe that they need a 20% down payment to buy a home? There has to be a reason! Today, we want to talk about four reasons why putting 20% down is a good plan, if you can afford it.

1. Your interest rate will be lower.

Putting down a 20% down payment vs. a 3-5% down payment shows your lender/bank that you are more financially stable, thus a good credit risk. The more confident your bank is in your credit score and your ability to pay your loan, the lower the rate they will be willing to give you.

2. You’ll end up paying less for your home.

The bigger your down payment, the lower your loan amount will be for your mortgage. If you are able to pay 20% of the cost of your new home at the start of the transaction, you will only pay interest on the remaining 80%. If you put down a 5% down payment, the extra 15% on your loan will accrue interest and end up costing you more in the long run!

3. Your offer will stand out in a competitive market!

In a market where many buyers are competing for the same home, sellers like to see offers come in with 20% or larger down payments. The seller gains the same confidence that the bank did above. You are seen as a stronger buyer whose financing is more likely to be approved. Therefore, the deal will be more likely to go through!

4. You won’t have to pay Private Mortgage Insurance (PMI)

Simply put, PMI is “an insurance policy that protects the lender if you are unable to pay your mortgage. It’s a monthly fee, rolled into your mortgage payment, that is required for all conforming, conventional loans that have down payments less than 20%.”

As we mentioned earlier, when you put down less than 20% to buy a home, your lender/bank will see your loan as having more risk. PMI helps them recover their investment in you if you are unable to pay your loan. This insurance is not required if you are able to put down 20% or more.

Many times, home sellers looking to move up to a larger or more expensive home are able to take the equity they earn from the sale of their house to put down 20% on their next home.

If you are looking to buy your first home, you will have to weigh the benefits of saving a 20% down payment vs. the time and cost of continuing to rent while you save that amount.

Bottom Line

If your plan for your future includes buying a home and you’re already saving for your down payment, let’s get together to help you decide what down payment size best fits with your long-term plan!

Seniors’ Guide to House Hunting in Charlotte

Buying a home for your retirement years opens up great possibilities. You can choose a location that offers amenities for you to make the most of retirement, which is an extremely liberating reality after a life of hard work. If you’re looking for a slightly smaller metropolitan area that still boasts all of the desirable aspects of city life, then Charlotte, North Carolina might be a great fit for you.

Charlotte is among the top 35 best places in the US to retire, according to rankings from U.S. News, much of this has to do with the abundance of senior-friendly activities the city has to offer. Charlotte has several museums and galleries in the downtown area, and residents have easy access to live theater. Seniors who love the great outdoors can enjoy the area’s many parks, trails and hiking opportunities.

Beyond entertainment and enjoyment, you’ll want to make sure you choose a house that is relatively close to healthcare facilities you may need. In this category, Charlotte remains a great choice. There are 238 physicians per 100,000 population in Charlotte, which exceeds the US average of 210 per 100,000 people. Additionally, in Charlotte, there are several local hospitals that are under magnet status, which is the highest credential for nursing practices across the world.

If you’re ready to start searching for potential homes in Charlotte, here are a few tips you should keep in mind:

Carefully Budget for Retirement

Charlotte residents love that the city is a very affordable place to live. According to real-estate website Zillow, the median home value in Charlotte is $224,200. This is slightly below the national median price of $229,800.

While real estate is definitely cost-effective in Charlotte, you’ll need to keep in mind that affording a house is more than just the down payment and mortgage – you need to make sure you are financially prepared to shoulder any financial burdens that may come with owning a home in the long haul.

Taxes are an important consideration when developing a retirement budget. Having a grip on how much you’ll need to pay in taxes will give you a clearer picture of what exactly you’ll have in your pocket each month. The tax environment in North Carolina is favorable for retirees. According to consumer finance company SmartAsset, Charlotte is considered to be tax-friendly for retirees. The state of North Carolina exempts all Social Security retirement benefits from income taxes, while other forms of retirement income are taxed at the state’s flat income tax rate of 5.499%. The state’s property and sales taxes are both moderate, and seniors may be eligible for a property tax break under homestead exclusion. Your real estate agent can help you determine your eligibility.

Find Amenities to Help You “Age in Place

In the ideal scenario, seniors can buy a home for their retirement that they can plan to stay in for the long haul. Your realtor can help you target homes that can age with you – even through health issues or mobility limitations. There are certain design elements that can help ensure your new home will always be appropriate for you, including a one-story layout, no-step entryways, wide hallways and shower grab bars.

Consider Other Senior Living Options in Charlotte

Buying a home isn’t the only option you have when it comes to relocating for retirement. If you don’t want to manage the chores that come with owning a home, but would still like to live independently, you should consider moving into a retirement community. These communities, also called “55-plus communities,” provide a safe environment that frees you from some home maintenance responsibilities you may need assistance with, allowing you to focus on those activities that bring you the most joy. Retirement communities often offer different amenities for you to maximize your retirement – including pools, fitness centers, arranged transportation and senior happy hours.

If you think you will need help with activities of daily living, including medication management, bathing or dressing, then an assisted living facility could be the best living option for you. There are many top-rated communities in the Charlotte area and more that are located in surrounding areas. Your realtor can help you narrow down the best communities that will suit your preferences and budget.

Connect With a Reliable Realtor

Having a reliable realtor by your side is an extremely crucial part of the house hunting process. You should take the time to think about and discuss with your realtor both big-picture issues like location, as well as small details like your daily lifestyle preferences. Ask prospective realtors if they’ve been trained in helping senior homebuyers in the 50-plus age range, and have transparent conversations about what you’re looking for in a new home, including budget and timeline.

Whether you are a Charlotte native or a retiree relocating to Charlotte from elsewhere, I can help you find the perfect home and make your move as stress-free as possible. If you are thinking of selling, buying or renting a home and would like more information on my services, please feel comfortable reaching to me. There is never any pressure placed on you and I am happy to help! Contact me, Roby Robertson, to get started.

Will Your Current House Fit Your Needs in Retirement?

Real Estate around Charlotte and Lake Norman

As more and more baby boomers enter retirement age, the question of whether or not to sell their homes and move will become a hot topic. In today’s housing market climate, with low available inventory in the starter and trade-up home categories, it makes sense to evaluate your home’s ability to adapt to your needs in retirement.

According to the National Association of Exclusive Buyers Agents (NAEBA), there are 7 factors that you should consider when choosing your retirement home.1

1. Affordability

“It may be easy enough to afford your home today but think long-term about your monthly costs. Account for property taxes, insurance, HOA fees, utilities – all the things that will be due whether or not you have a mortgage on the property.”

Would moving to a complex with homeowner association (HOA) fees actually be cheaper than having to hire all the contractors you would need to maintain your home, lawn, etc.? Would your taxes go down significantly if you relocated? What is your monthly income going to be like in retirement?

2. Equity

“If you have equity in your current home, you may be able to apply it to the purchase of your next home. Maintaining a healthy amount of home equity gives you a source of emergency funds to tap, via a home equity loan or reverse mortgage.”

The equity you have in your current home may be enough to purchase your retirement home with little to no mortgage. Homeowners in the US gained an average of over $16,300 in equity last year.

3. Maintenance

“As we age, our tolerance for cleaning gutters, raking leaves and shoveling snow can go right out the window. A condominium with low-maintenance needs can be a literal lifesaver, if your health or physical abilities decline.”

As we mentioned earlier, would a condo with an HOA fee be worth the added peace of mind in knowing that you do not have to do the maintenance work yourself?

4. Security

“Elderly homeowners can be targets for scams or break-ins. Living in a home with security features, such as a manned gate house, resident-only access and a security system can bring peace of mind.”

As scary as that thought may be, any additional security and an extra set of eyes looking out for you always adds to peace of mind.

5. Pets

“Renting won’t do if the dog can’t come too! The companionship of pets can provide emotional and physical benefits.”

Evaluate all of your options when it comes to bringing your ‘furever’ friend with you to a new home. Will there be necessary additional deposits if you are renting or moving in to a condo? Is the backyard fenced in? How far are you from your favorite veterinarian?

6. Mobility

“No one wants to picture themselves in a wheelchair or a walker, but the home layout must be able to accommodate limited mobility.”

Sixty is the new 40, right? People are living longer and are more active in retirement, but that doesn’t mean that down the road you won’t need your home to be more accessible. Having to install handrails and make sure that your hallways and doorways are wide enough may be a good reason to look for a home that was built to accommodate these needs.

7. Convenience

“Is the new home close to the golf course, or to shopping and dining? Do you have amenities within easy walking distance? This can add to home value!”

How close are you to your children and grandchildren? Would relocating to a new area make visits with family easier or more frequent? Beyond being close to your favorite stores and restaurants, there are a lot of factors to consider.

Bottom Line

When it comes to your forever home, evaluating your current house for its ability to adapt with you as you age can be the first step to guaranteeing your comfort in retirement. If after considering all these factors you find yourself curious about your options, let’s get together to evaluate your ability to sell your house in today’s market and get you into your dream retirement home!

4 Reasons This Spring Market Is Better Than Last Year

If you’re looking to buy or sell a home this year, now is a great time! Let’s get together today to go over what is happening in the Spring Market and what it means for you. Carolina Living Real Estate has been successful selling homes all over Charlotte and Lake Norman saving clients money. Let us show you how.

About Today’s Charlotte Real Estate Market

3 Graphs that Show What You Need to Know About Today’s Real Estate Market

The Housing Market has been a hot-topic in the news lately. Depending on which media outlet you watch, it can start to be a bit confusing to understand what’s really going on with interest rates and home prices!

The best way to show what’s really going on in today’s real estate market is to go straight to the data! We put together the following three graphs along with a quote from Chief Economists that have their finger on the pulse of what each graph illustrates.

Interest Rates:

“The real estate market is thawing in response to the sustained decline in mortgage rates and rebound in consumer confidence – two of the most important drivers of home sales. Rising sales demand coupled with more inventory than previous spring seasons suggests that the housing market is in the early stages of regaining momentum.” – Sam Khater, Chief Economist at Freddie Mac

Income:

“A powerful combination of lower mortgage rates, more inventory, rising income and higher consumer confidence is driving the sales rebound.” – Lawrence Yun, Chief Economist at NAR

Home Prices:

“Price growth has been too strong for several years, fueled in part by abnormally low interest rates. A mild deceleration in home sales and Home Price Index growth is actually healthy, because it will calm excessive price growth — which has pushed many markets, particularly in the West, into overvalued territory.” – Ralph DeFranco, Global Chief Economist at Arch Capital Services Inc.

Bottom Line

These three graphs indicate good news for the spring housing market! Interest rates are low, income is rising, and home prices have experienced mild deceleration over the last 9 months. If you are considering buying a home or selling your house, let’s get together to chat about our market!

Put Your Charlotte Housing Costs to Work!

How to Put Your Housing Cost to Work for You

Your Charlotte and Lake Norman area Realtor wants to keep you informed. Please contact Roby Robertson with any of your Real Estate Questions! Warm weather is upon us and the market will begin to build!!

There has been a lot written about the benefits of homeownership. One benefit that continues to rise to the top is the added wealth homeowners gain simply by paying their mortgage while their home increases in value over time.

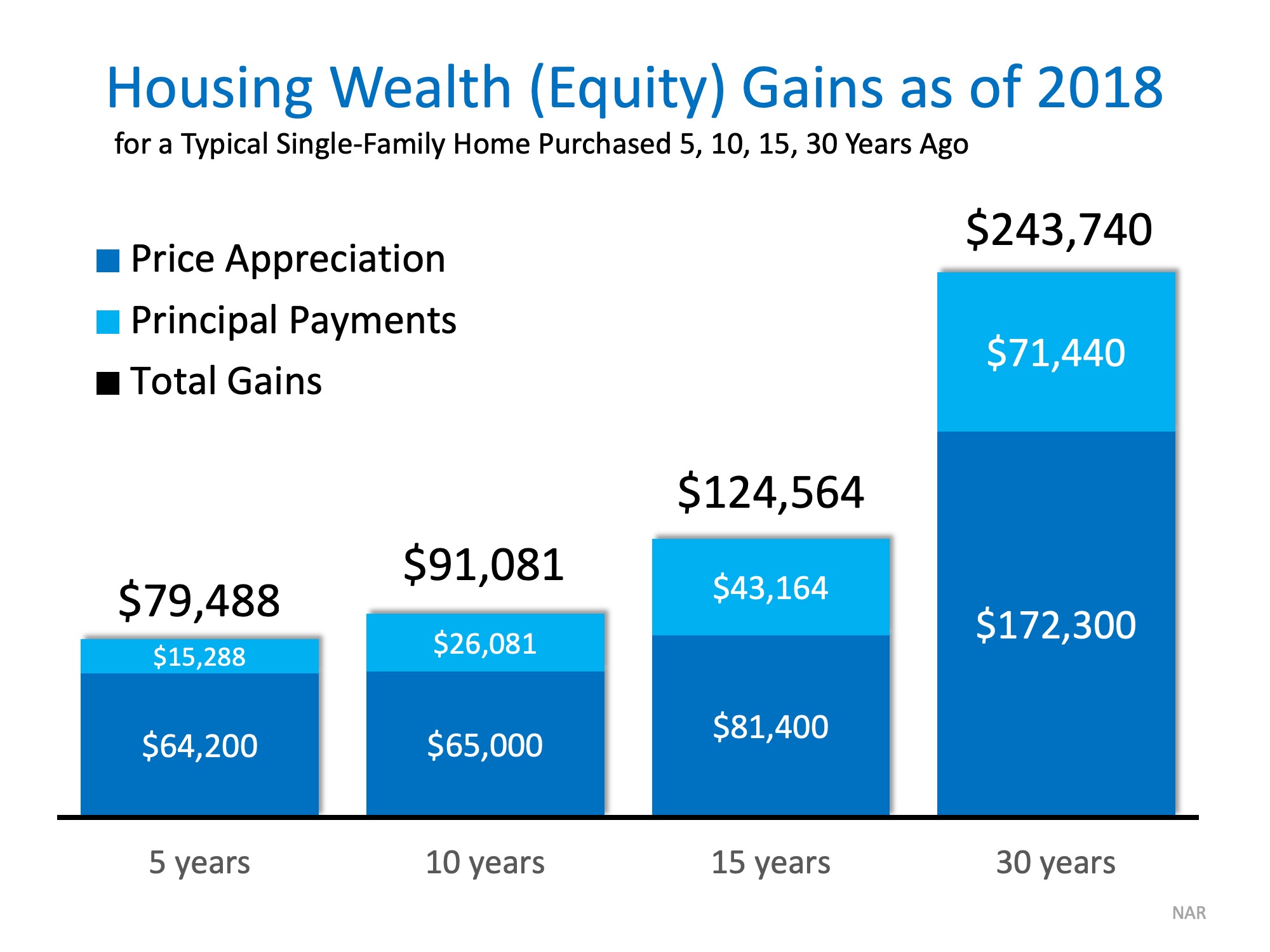

The National Association of Realtors (NAR) recently broke down the equity gained from price appreciation and principal payments in their Economists Outlook Blog. Homeowners who purchased their homes five years ago have already gained almost $80,000 in equity over that time with 80% of the gains coming from price appreciation.

For a homeowner who purchased their home 30 years ago, they have gained nearly $250,000 in equity with 70% coming from price increases. The full results can be seen in the chart below.

According to the Home Price Expectation Survey, a family who purchased a median priced home this January can expect to gain more than $42,000 over the next five years simply from price appreciation alone.

Bottom Line

Your home is one of the only investments you can live inside as you pay it off over time. If you are ready to use your housing costs to build wealth, let’s get together to discuss how to make your dream a reality.

What’s Going On With Real Estate Bidding Wars?

What’s Going On with Bidding Wars?

In a strong seller’s market, like the one we have experienced over the past few years, bidding wars are common and expected. This makes sense! A seller’s market is defined as a market in which the inventory of homes for sale cannot satisfy the number of buyers who want to purchase a home.

According to the Cambridge English Dictionary, bidding wars occur when two or more parties repeatedly outbid each other as they compete to purchase something- in this case, a home.

In some areas of the country, first-time buyers have been met with fierce competition throughout their experience. Some have been out-bid multiple times before finally winning a bid on a home to call their own.

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), there is currently a 3.7-month supply of homes for sale.

With the current number of houses listed for sale and the level of demand from buyers, this means it would take 3.7 months for all the homes listed to sell if no additional listings came to market. Any supply number under a 6-month supply is considered a seller’s market. According to NAR, the housing market hasn’t had a 6-month supply of homes for sale since August 2012.

Good News for Buyers

A recent report shows that the percentage of houses sold including a bidding war before settling on a final price decreased from 53% in January of 2018 to 13% this year.

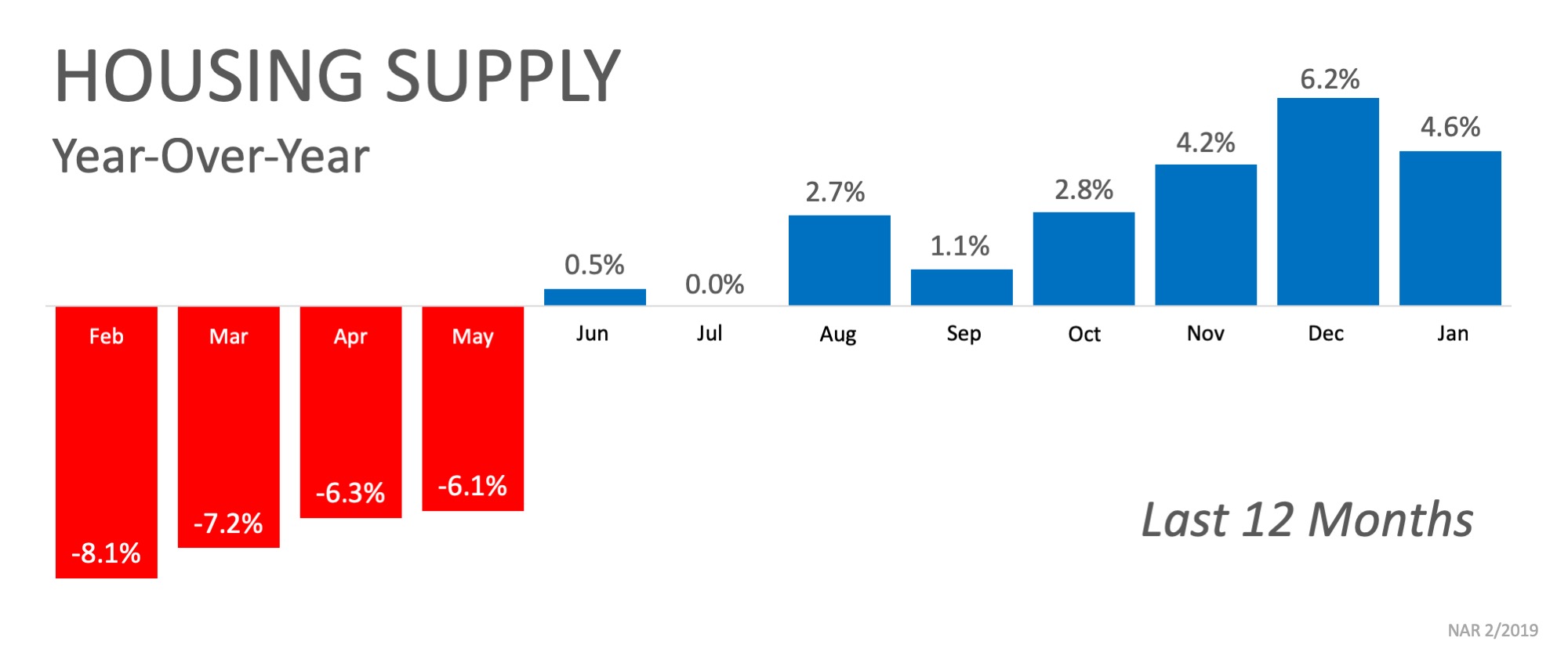

One reason for the decline is an influx of homes being listed for sale. Even though the month’s supply number is not increasing, the number of homes for sale is. The chart below shows the year-over-year change in inventory over the last 12 months.

As you can see, the number of homes for sale has started to build over the last eight months. Prior to this reversal, inventory levels had fallen for 36 consecutive months when compared to the year before.

Danielle Hale, realtor.com’s Chief Economist, gave some insight into why bidding wars are less common on a local level this year,

“[Last year] you might have been the only listing in your neighborhood, and you could put your home up at a certain list price and you would likely see multiple offers at or above that list price. That tide is turning this year.

It’s going to depend on what neighborhood you’re in, but we expect it to be more common this year that you won’t be the only listing.”

Inventory in the luxury and premium markets (the top 25% of listings in an area by price), is increasing at a greater rate than the starter home market. As the choices buyers have continued to increase, the likelihood of a bidding war will decrease.

Bottom Line

If you are debating listing your house for sale this year, you may not want to wait for additional competition as inventory continues to rise.

4 Reasons to Buy Your Charlotte Area Home in the Spring

Spring has sprung, and it’s a great time to buy a home! Here are four reasons to consider buying today instead of waiting.

1. Prices Will Continue to Rise

CoreLogic’s latest U.S. Home Price Insights reports that home prices have appreciated by 4.4% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 4.6% over the next year.

Home values will continue to appreciate for years. Waiting no longer makes sense.

2. Mortgage Interest Rates Are Projected to Increase

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year fixed rate mortgage came in at 4.41% last week. Most experts predict that rates will rise over the next 12 months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac, and the National Association of Realtors are in unison, projecting rates will increase by this time next year.

An increase in rates will impact YOUR monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is necessary to buy your next home.

3. Either Way, You Are Paying a Mortgage

Some renters have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to have equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing cost to work for you?

4. It’s Time to Move On with Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.

But what if they weren’t? Would you wait?

Examine the actual reason you are buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, greater safety for your family, or you just want to have control over renovations, now could be the time to buy.

Bottom Line

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings.

Excited To Buy Your Charlotte Area Home?

Excited About Buying A Home This Year? Here’s What to Watch

Here is some information and a place to gather more information as you make this big decision. Feel free to contact us and we will do all we can to help you !

As we kick off the new year, many families have made resolutions to enter the housing market in 2019. Whether you are thinking of finally ditching your landlord and buying your first home or selling your starter house to move into your forever home, there are two pieces of the real estate puzzle you need …Continue Reading