We believe every family should feel confident when buying and selling their Charlotte Area Home home.

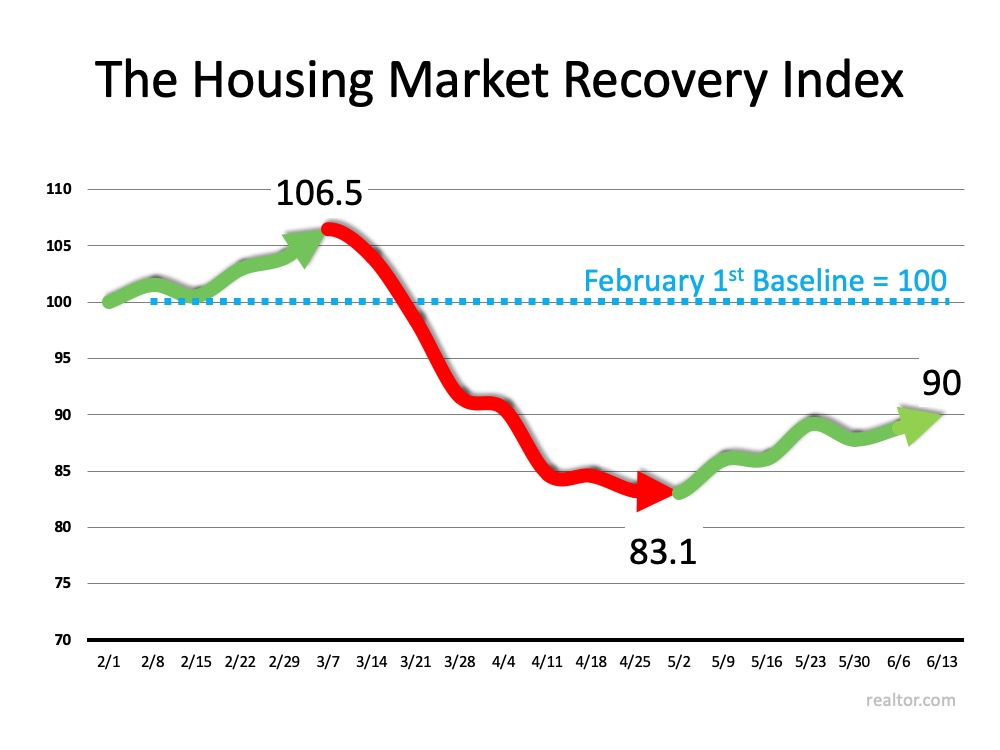

The number of houses for sale today is significantly lower than the high buyer activity in the current housing market. According to Lawrence Yun, Chief Economist for the National Association of Realtors (NAR):

“There is no shortage of hopeful, potential buyers, but inventory is historically low.”

When the demand for homes is higher than what’s available for sale, it’s a great time for homeowners to sell their house. Here are three ways low inventory can help you win if you’re ready to make a move this fall.

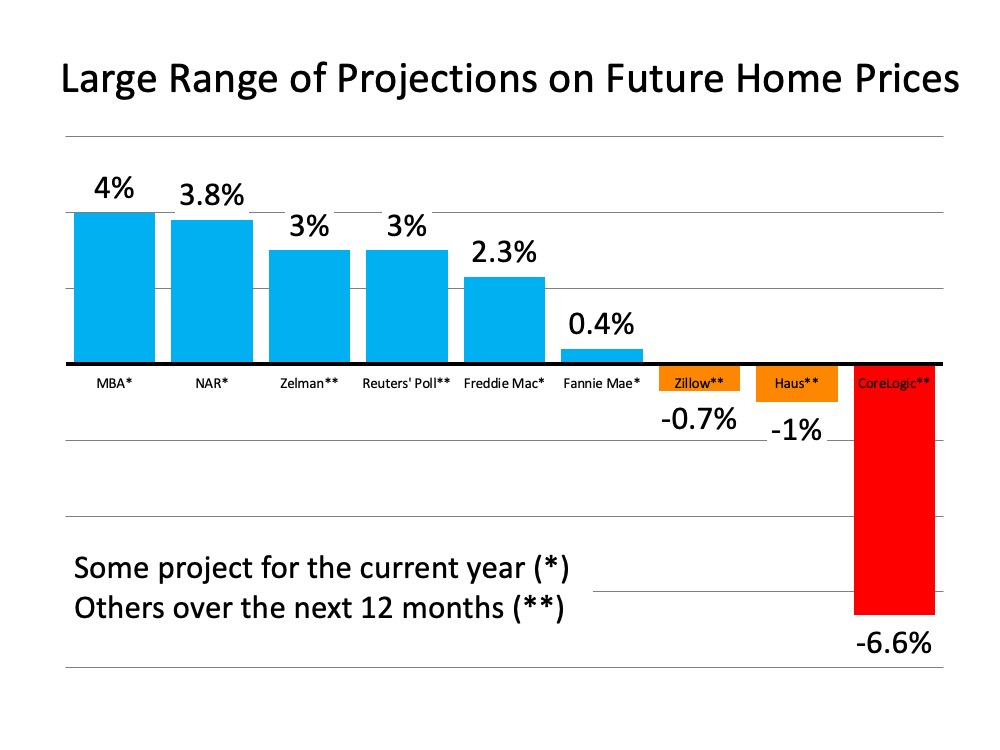

1. Higher Prices

With so many more buyers in the market than homes available for sale, homebuyers are frequently entering into bidding wars for the houses they want to purchase. This buyer competition drives home prices up. As a seller, this can definitely work to your advantage, potentially netting you more for your house when you close the deal.

2. Greater Return on Your Investment

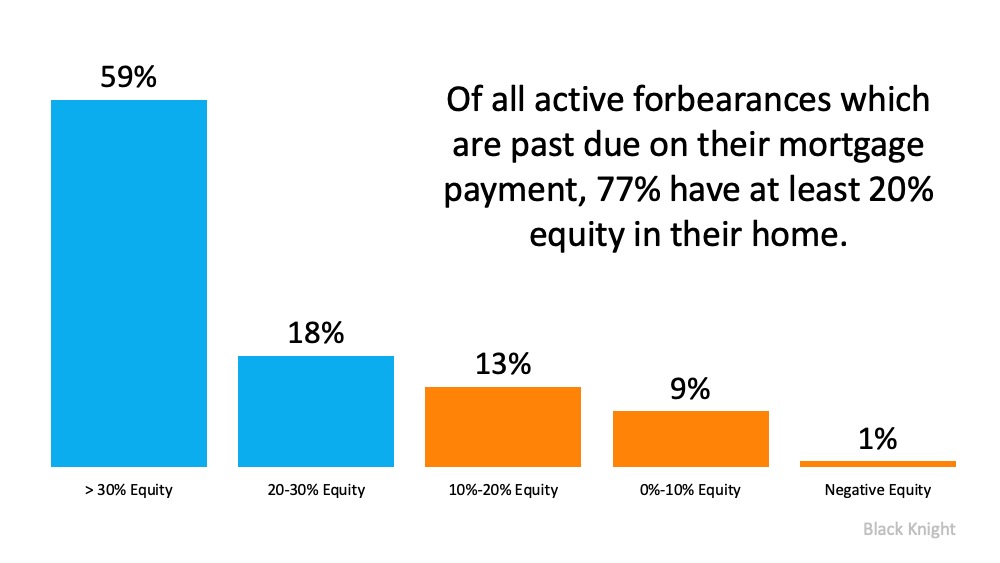

Rising prices mean homes are also gaining value, which drives an increase in the equity you have in your home. In the latest Homeowner Equity Insights Report, CoreLogic explains:

“In the second quarter of 2020, the average homeowner gained approximately $9,800 in equity.”

This year-over-year growth in equity gives you the ability to put that money toward a down payment on your next home or to keep it as extra savings.

3. Better Terms

When we’re in a sellers’ market like we are today, you’re in the driver’s seat if you sell your house. You have the power to sell on your terms, and buyers are more likely to work with you if it means they can finally move into their dream home.

So, is low housing inventory a big deal?

Yes, especially if you want to sell your house at the perfect time. Today’s market gives sellers immense negotiating power. However, it won’t last forever, especially as more sellers return to the housing market next year. If you’re considering selling your house, the best time to do so is now.

Bottom Line

If you’re interested in taking advantage of the current sellers’ market, let’s connect today to determine your best move in our local market.